Louis Vuitton Men 2026: How to Monetise Home‑Coded Style

Case study snapshot

Pharrell’s LV Men’s FW26 opened Paris Men’s Fashion Week with “DROPHAUS”, a prefabricated glass house built with NOT A HOTEL, positioning the show as a concept for future living rather than just a runway. The collection focused on crisp tailoring, technical fabrics and travel‑friendly pieces, signalling a pivot from hype-heavy streetwear to commercially minded, lived‑in luxury.

Core thesis: Louis Vuitton Men’s FW26 is more than a collection. It is a live prototype for how luxury can sell home‑coded, lifespan dressing to a global, digitally native audience while protecting pricing power.

Trend analysis

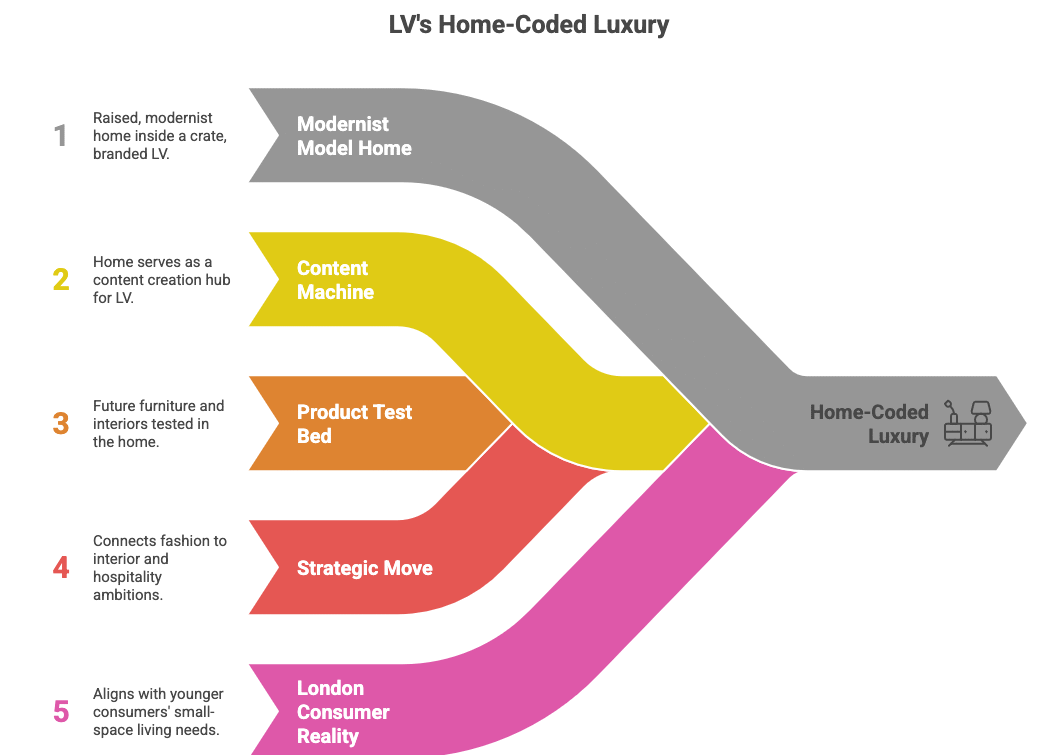

1. Home-coded luxury

- The set: A raised, modernist model home inside a crate, branded “Louis Vuitton Fall-Winter 26 Men’s Collection,” doubling as a content machine and future product test bed for furniture and interiors.

- Strategic move: Pharrell connects fashion to interior and hospitality ambitions (e.g. the reported LV hotel on the Champs‑Élysées), expanding the share of “home life” that LV can monetise.

My insight: This aligns with younger consumers’ reality, small flats, curated objects, and clothes that have to live in the same 500 square feet as work, social life and content creation.

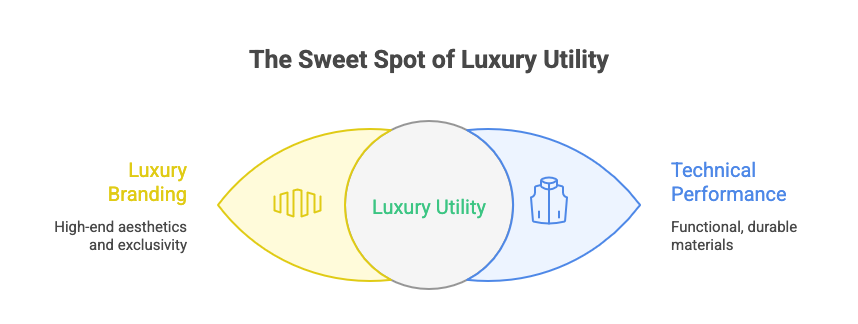

2. From hype to “industrial serenity” Pharrell’s POV

- Tailoring and technical fabrics: Flared trousers, six‑button jackets, reflective fabrics, padded jackets and travel‑ready jerkins aimed at long‑haul wear, not just front‑row moments.

- The mood is “industrial serenity”: Calming neutrals, technical performance and detail‑obsessed construction instead of logo‑screaming streetwear.

Market signal: Luxury brands are trying to keep high margins while responding to recession‑ish consumer sentiment; products must justify price with utility, not just hype.

3. Travel and hybrid workwear

- LV leans into “art of travel” heritage with pieces designed to avoid creasing, work across climates and read polished on arrival.

- This syncs with how London professionals actually live like hybrid schedules, frequent European city breaks, and wardrobes that need to flip from commute to client dinner.

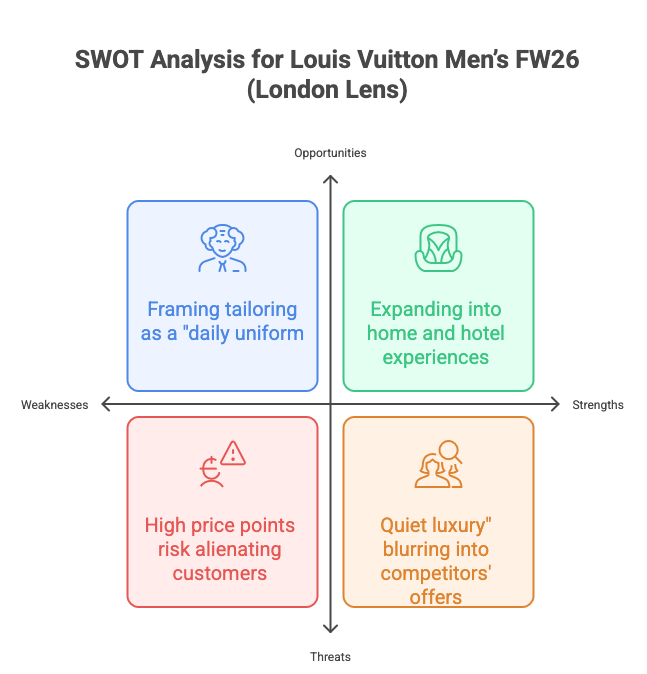

SWOT for Pharrell’s Paris LV Men’s FW26 (London-based)

Strengths

- Unmatched brand equity and cultural heat via Pharrell, still one of the few menswear shows that cuts through mainstream media and social.

- Strong alignment with LV’s DNA, travel, craftsmanship, architectural storytelling, now extended via interiors and hospitality.

Weaknesses

- High price points of Pharell’s line risk feeling out of touch for squeezed Gen Z/young millennial customers in cities like London facing rising living costs.

- “Quiet luxury” can blur into competitors’ offers (The Row, Brunello Cucinelli, Loewe tailoring) if storytelling is not pointed enough.

Opportunities

- Expand into home, furniture and hotel experiences anchored in the DROPHAUS aesthetic, deepening lifetime value per client.

- Grow menswear share by framing tailoring as a “daily uniform” for hybrid work and creative industries, not just suits for bankers.

Threats

- Macro headwinds: Slower luxury growth forecast through 2026, with aspirational shoppers trading down or buying less often.

- Competitive sets like Kering and Richemont houses also chasing hybrid tailoring, technical fabrics and lifestyle storytelling.

Market research highlights

- Luxury market cooling, but still up

- Global personal luxury goods are expected to grow at a slower single‑digit rate through 2026 after post‑pandemic spikes, with demand shifting towards more timeless, functional pieces rather than seasonal novelty.

- Gen Z priorities: value, identity, planet

- Younger shoppers care about cost‑per‑wear, resale value and emotional resonance of a brand story, not just logos; they mix luxury with high street and rental to build “uniforms” that feel uniquely theirs.

- London as a key testbed

- London is one of Europe’s major luxury hubs with dense tourism, high‑spend locales (Bond Street, Knightsbridge) and a strong pre‑owned ecosystem, making it ideal for testing hybrid, lifespan‑dressing propositions that can be styled up or down.

5 unconventional, consultant‑style recommendations (London‑based)

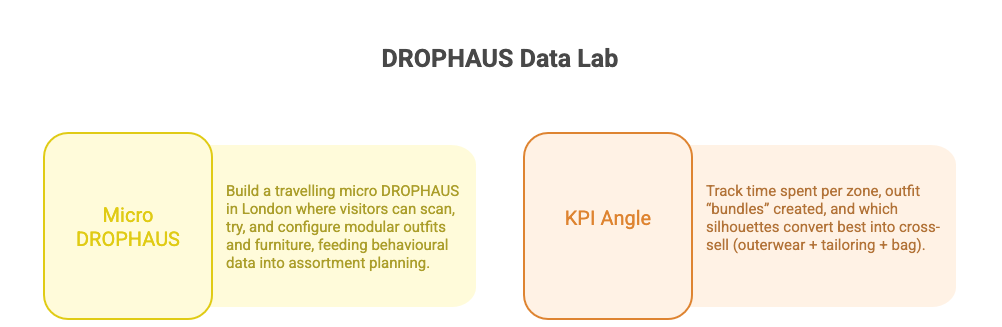

- Turn DROPHAUS into a data lab, not just a set

- Build a travelling “micro DROPHAUS” in London (think Shoreditch, Coal Drops Yard, Mayfair pop‑up) where visitors can scan, try and configure modular outfits and furniture, feeding behavioural data into assortment planning.

- KPI angle: track time spent per zone, outfit “bundles” created, and which silhouettes convert best into cross‑sell (outerwear + tailoring + bag).

2. Launch a “London Uniform Index”

- Use computer vision + in‑store observation to map how Londoners actually wear tailoring, outerwear and bags on commute corridors (Liverpool Street, London Bridge, King’s Cross).

- Quarterly index: top silhouettes, colour clusters, and bag‑usage patterns, then publicly share edited insights as brand content while using the full dataset to tweak assortments and styling for the UK market.

3. Create a tiered “Lifespan Dressing” offer

- At the LV level: emphasise care, alteration and repair to extend garment life, with data‑driven prompts (e.g. invite clients for refresh services after X wears or Y months).

- For smaller brands reading your blog: build three price tiers around one silhouette (entry capsule, elevated edition, limited artisanal drop) to encourage repeat purchases within a single, recognisable uniform.

4. Bundle home and wardrobe in one experience

- In London flagships, stage “room sets” with looks styled on rails next to objects, art and sound, allowing clients to buy into a whole mood instead of single SKUs.

- Encourage UK independents to do the same with local partners (ceramicists, furniture studios, cafés), turning stores into mini Pharrell’s DROPHAUS‑style living spaces and sharing costs through collaboration.

5. Measure “depth, not noise” as a strategic KPI

- Replace simple social metrics with a depth score: repeat customer rate, average categories per basket, and number of garments that appear in user‑generated content multiple times over months, not just once at purchase.

- Narratively, this ties back to Pharrell’s quieter, tailoring‑led direction: the win is not viral moments, but pieces that keep reappearing in real wardrobes, especially in cities like London where outfits must work hard all week.